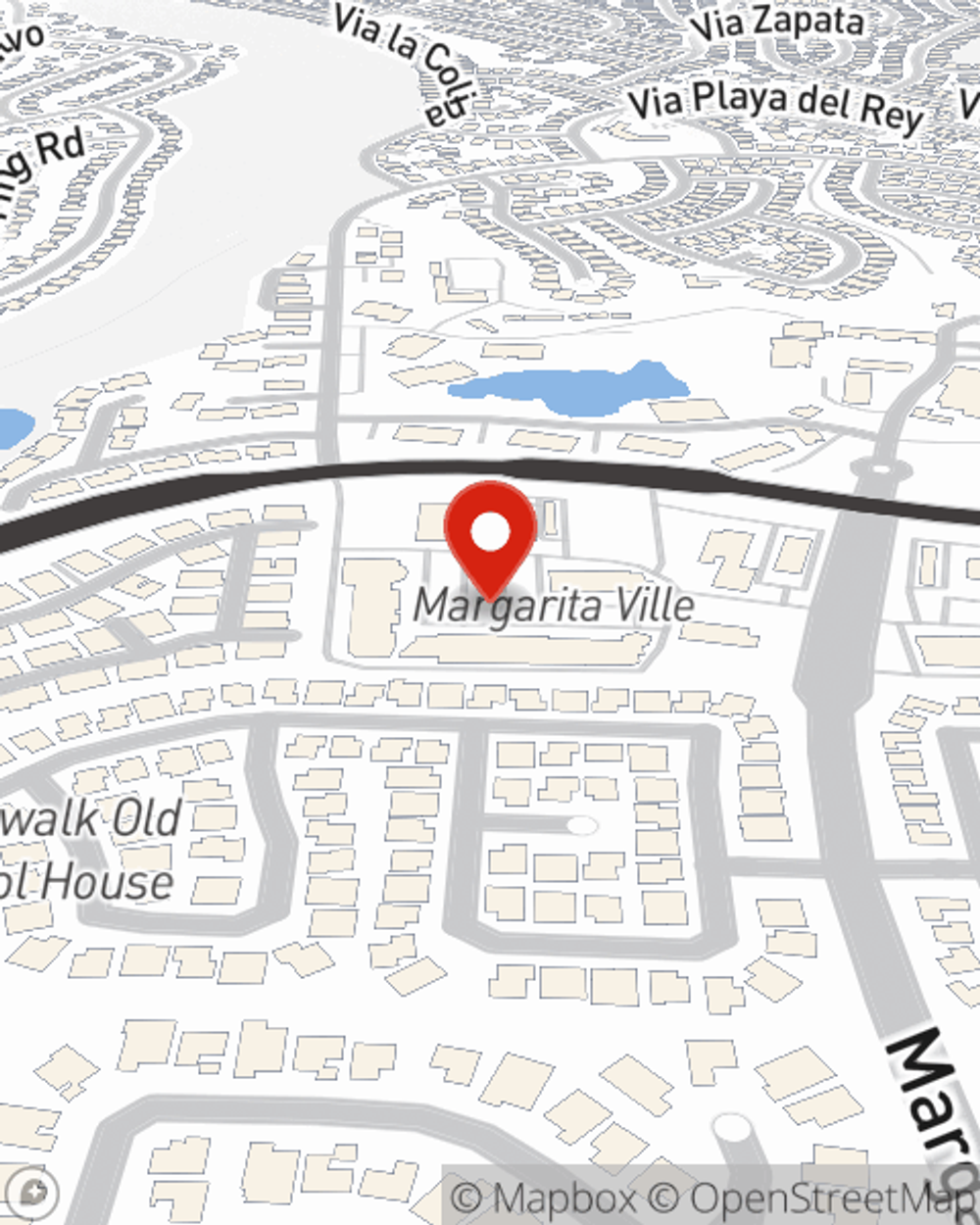

Renters Insurance in and around Murrieta

Looking for renters insurance in Murrieta?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Riverside County

- Murrieta

- Temecula

- Winchester

- Menifee

- San Diego County

- Orange County

- Fallbrook

- Hemet

- Lake Elsinore

- Wildomar

- Corona

- Riverside

- Perris

- Anaheim

- Yorba LInda

- Phoenix

- California

- Arizona

Home Is Where Your Heart Is

No matter what you're considering as you rent a home - number of bedrooms, location, internet access, townhome or condo - getting the right insurance can be vital in the event of the unpredictable.

Looking for renters insurance in Murrieta?

Your belongings say p-lease and thank you to renters insurance

There's No Place Like Home

The unanticipated happens. Unfortunately, the valuables in your rented property, such as a coffee maker, a cooking set and a desk, aren't immune to tornado or abrupt water damage. Your good neighbor, agent Scott Koth, is dedicated to helping you figure out a policy that's right for you and find the right insurance options to protect your belongings from the unexpected.

It's always a good idea to make sure you're prepared. Call or email State Farm agent Scott Koth for help getting started on savings options for your rented unit.

Have More Questions About Renters Insurance?

Call Scott at (951) 461-4979 or visit our FAQ page.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.